UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by Registrant x☒ Filed by a party other than the Registrant ¨☐

Check the appropriate box:

| Preliminary Proxy Statement | ||

| Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2)) | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material Pursuant to | ||

THE CENTRAL EUROPE, RUSSIA AND EASTERN

TURKEYEUROPE FUND, INC.

THE EUROPEAN EQUITY FUND, INC.

THE NEW GERMANY FUND, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| No fee required. | |||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| Fee paid previously with preliminary materials. | |||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

THE CENTRAL EUROPE, RUSSIA AND TURKEYEASTERN EUROPE FUND, INC.

THE EUROPEAN EQUITY FUND, INC.

THE NEW GERMANY FUND, INC.

345 Park Avenue

New York, New York 10154

NOTICE OF JOINT ANNUAL MEETING OF STOCKHOLDERS

June 26, 201522, 2018

To the stockholders of The Central Europe, Russia and TurkeyEastern Europe Fund, Inc., The European Equity Fund, Inc. and The New Germany Fund, Inc.:

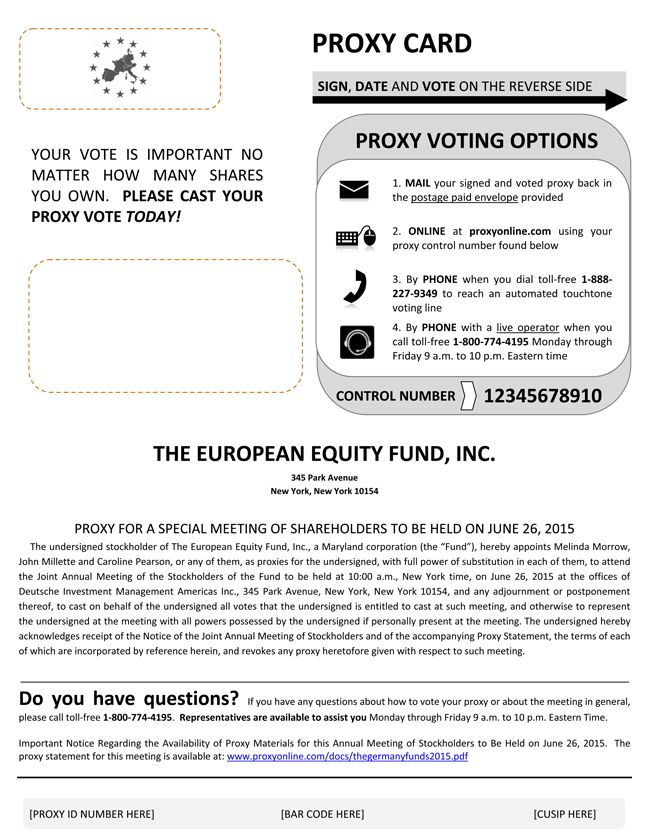

Notice is hereby given that the joint Annual Meeting of Stockholders (the “Meeting”) of The Central Europe, Russia and TurkeyEastern Europe Fund, Inc. (“CEE”), The European Equity Fund, Inc. (“EEA”) and The New Germany Fund, Inc. (“GF”), each a Maryland corporation (each a “Fund,” and collectively, the “Funds”), will be held at 10:00 a.m., New York time, on Friday, June 26, 201522, 2018 at the offices of Deutsche Investment Management Americas Inc., 345 Park Avenue, New York, New York 10154 for the following purposes:

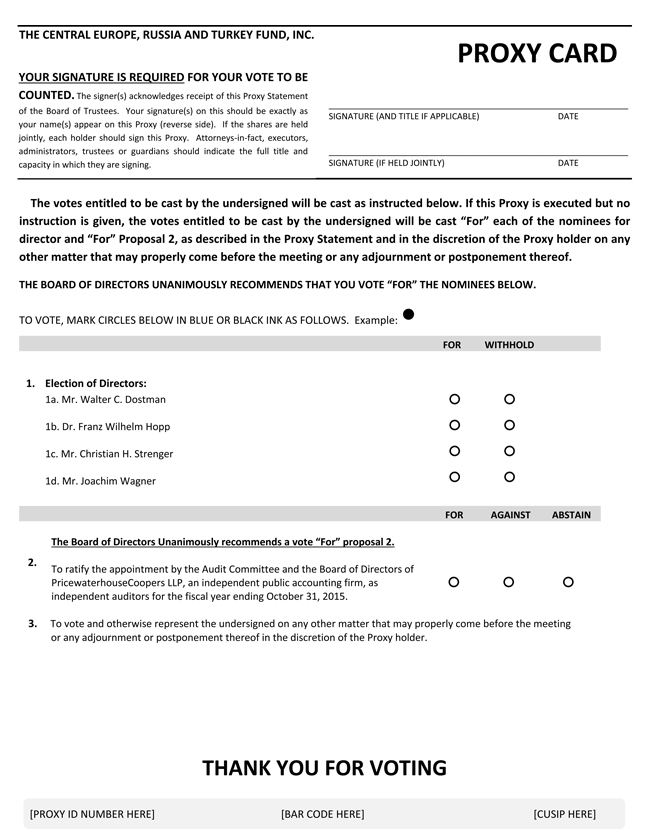

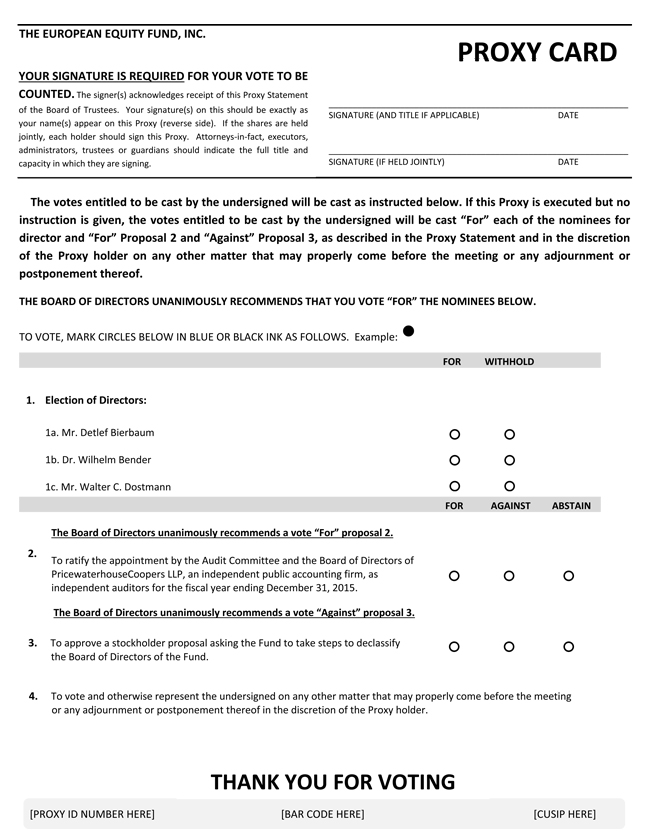

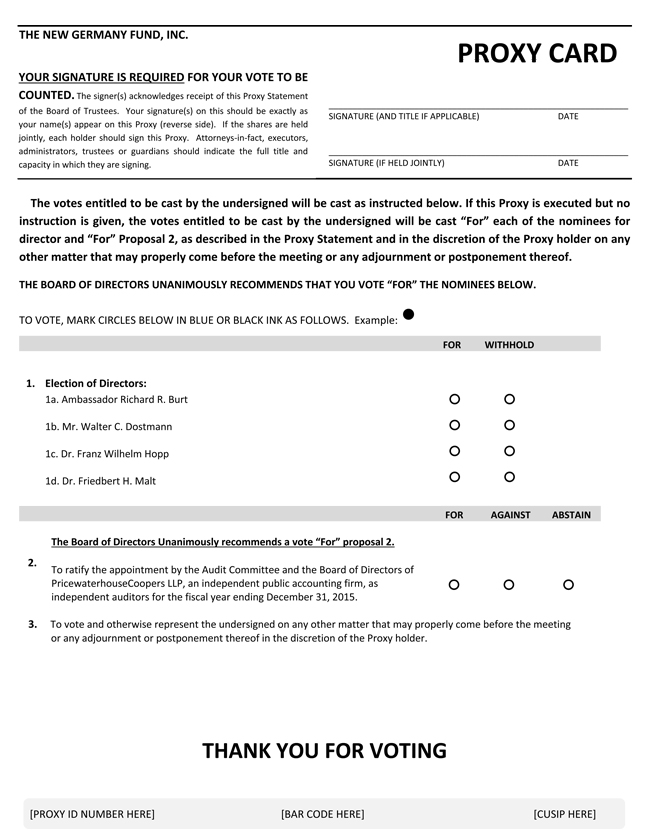

1. To elect Directors of each Fund as outlined below:

(A) For EEA only, to elect three (3) Directors of the Fund, each to serve for a term of three years and until his successor is elected and qualifies.

(B) For CEE and GF only, to elect four (4)two (2) Directors of each Fund, each to serve until the expiration of his applicable term and until his successor is elected and qualifies.

2. To ratify the appointment by the Audit Committee and the Board of Directors of PricewaterhouseCoopers LLP, an independent registered public accounting firm, as independent auditors for the fiscal year ending October 31, 20152018 for CEE and for the fiscal year ending December 31, 20152018 for EEA and GF.

3.For EEA only: To act upon, if properly presented, one stockholder proposal.

4. To transact such other business as may properly come before the Meeting or any postponement or adjournment thereof.

Only holders of record of Common Stock of each Fund at the close of business on May 12, 2015April 27, 2018 are entitled to notice of, and to vote at, this Meeting or any postponement or adjournment thereof. Proxies are being solicited on behalf of the Board of Directors of each Fund.

By Order of the Boards of Directors

John Millette

Secretary

Dated: May 26, 20159, 2018

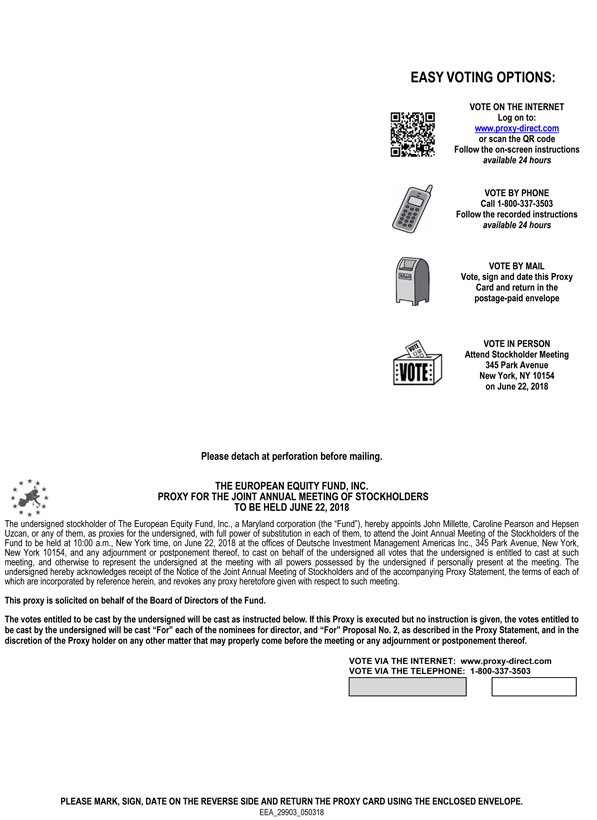

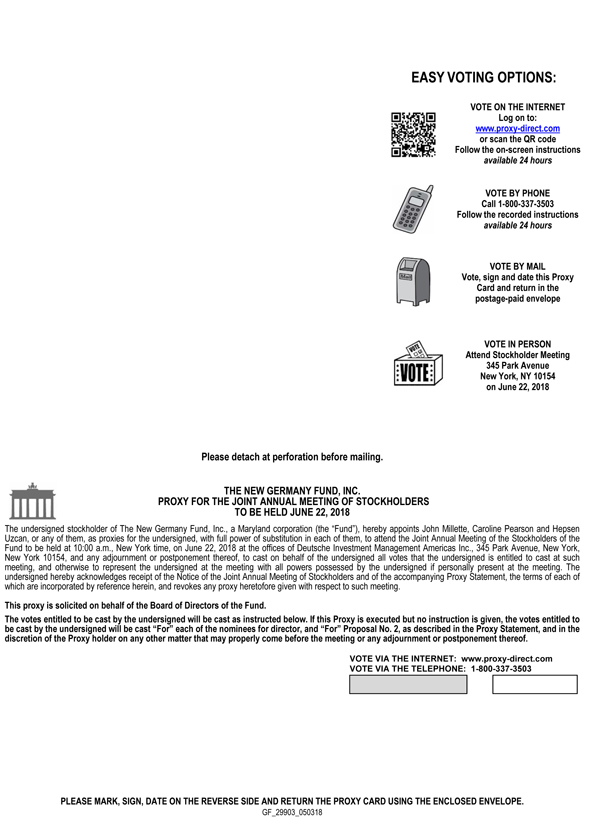

We urge you to mark, sign, date and mail the enclosed proxy card in the postage-paid envelope provided or to record your voting instructions by telephone or via the Internet so that you will be represented at the Meeting. If you complete and sign the proxy card (or tell us how you want to vote by voting by telephone or via the Internet), we will vote your shares exactly as you tell us. If you simply sign the proxy card, we will vote your shares in accordance with the Board’s recommendation on the Proposals. Your prompt return of the enclosed proxy card (or your voting by telephone or via the Internet) may prevent the necessity and expense of further solicitations. If you have any questions, please call AST Fund Solutions,Georgeson LLC, each Fund’s proxy solicitor, at 55 Challenger Road, Suite 201, Ridgefield Park, NJ 07660 or at the special toll-free number we have set up for you (1-800-774-4195),1-866-785-7395, or contact your financial advisor.

THE CENTRAL EUROPE, RUSSIA AND TURKEYEASTERN EUROPE FUND, INC.

THE EUROPEAN EQUITY FUND, INC.

THE NEW GERMANY FUND, INC.

345 Park Avenue

New York, New York 10154

Joint Annual Meeting of Stockholders

June 26, 201522, 2018

PROXY STATEMENT

This joint Proxy Statement is furnished by the respective Boards of Directors (collectively, the “Board of Directors” or “Board”) of The Central Europe, Russia and TurkeyEastern Europe Fund, Inc. (“CEE”), The European Equity Fund, Inc. (“EEA”) and The New Germany Fund, Inc. (“GF”), each a Maryland corporation (each, a “Fund” and collectively, the “Funds”), in connection with the solicitation of proxies for use at the joint Annual Meeting of Stockholders (the “Meeting”) to be held at 10:00 a.m., New York time, on Friday, June 26, 201522, 2018 at the offices of Deutsche Investment Management Americas Inc., 345 Park Avenue, New York, New York 10154. The purpose of the Meeting and the matters to be considered are set forth in the accompanying Notice of Joint Annual Meeting of Stockholders.

The Meeting is being held to consider and to vote on the following proposals for the Funds, as indicated below and as described more fully herein, and such other matters as may properly come before the meeting:

Proposal No. 1 (All Funds) | To elect 2 Directors of each Fund. | |

Proposal No. 2 (All Funds) | To ratify the appointment by the Audit Committee and the Board of Directors of PricewaterhouseCoopers LLP, independent registered public accounting firm, as independent auditors for each Fund’s current fiscal year. |

If the accompanying Proxy Card for your Fund is executed properly and returned, shares represented by it will be voted at the Meeting, and any postponement or adjournment thereof, in accordance with the instructions on the Proxy Card. However, if no instructions are specified, shares will be voted FOR the election of three (3) directors of EEA and four (4)two (2) directors of each of CEE and GFFund nominated by the Board (“Proposal No. 1”), and FOR the ratification of the appointment by the Audit Committee and the Board of PricewaterhouseCoopers LLP, an independent public accounting firm, as independent auditors for each Fund (“Proposal No. 2”) and, with respect to EEA only, AGAINST the stockholder proposal regarding Board declassification (“Proposal 3”). A proxy may be revoked at any time prior to the time it is voted by written notice to the Secretary of a Fund, by submitting a subsequently executed and dated Proxy Card or by attending the Meeting and voting in person.

If a stockholder owns shares Stockholders do not have dissenters’ rights of a Fundappraisal in violation of applicable law, including the Investment Company Act of 1940, as amended (the “Investment Company Act”), the Fund may determine thatconnection with any vote attributable to such shares shall not be counted, or that such shares will not be counted for quorum purposes, or both. Under Section 12(d)(1) of the Investment Company Act,matters to be voted on by the acquisition of more than 3% of a Fund’s common stock by another fund (whether registered, private or offshore) is unlawful. There is legal uncertainty aboutstockholders at the operation of Section 12(d)(1) and about a Fund’s right under federal and state law to invalidate votes cast by any person whose Fund shares are held in violation of law. Each Fund, if necessary, may seek judicial resolution of the uncertainty in any particular case.Meeting.

The close of business on May 12, 2015April 27, 2018 has been fixed as the record date for the determination of stockholders entitled to notice of, and to vote at, the Meeting. On that date, CEE had 8,673,456.517,012,463 shares of Common Stock outstanding and entitled to vote, EEA had 8,719,124.8457,951,000 shares of Common Stock outstanding and entitled to vote and GF had 15,933,821.9715,814,466 shares of Common Stock outstanding and entitled to vote. Each share will be

entitled to one vote on each matter that comes before the Meeting and each fractional share will be entitled to a proportionate fractional share on each matter that comes before the Meeting. It is expected that the joint Notice of Annual Meeting, this Proxy Statement and the Proxy Card(s) will first be mailed to stockholders on or about May 28, 2015.14, 2018.

For each Fund, a quorum is necessary to hold a valid meeting. If stockholders entitled to castone-third of all votes entitled to be cast at the Meeting are present in person or by proxy, a quorum will be established. Each Fund intends to treat properly executed Proxy Cards that are marked “abstain” and brokernon-votes (defined below) as present for the purposes of determining whether a quorum has been achieved at the Meeting. Each nominee for Director set forth in Proposal No. 1 shall be elected as a Director of the applicable Fund if such nominee receives the affirmative vote of a majority of the total number of votes entitled to be cast at the Meeting with respect to such Fund, provided a quorum for such Fund is present. Ratification of the appointment of PwC as each Fund’s independent auditor for the current fiscal year requires the affirmative vote of a majority of the votes cast at the Meeting with respect to such Fund provided a quorum for such Fund is present. ApprovalA “brokernon-vote” is deemed to have occurred when a proxy received from a broker indicates that the broker does not have discretionary authority to vote the shares on the matter. Because the election of the stockholder proposal to declassify the Boarda nominee for Director of EEA as set forth in Proposal 3a Fund requires the affirmative vote of a majority of the total number of votes entitled to be cast at the Meeting with respect to EEA, provided a quorum for EEA is present.of the applicable Fund, abstentions and brokernon-votes will have the effect of votes “against” the nominee. Under Maryland law, abstentions do not constitute a vote “for” or “against” a matter and will be disregarded in determining the “votes cast” on an issue. A “brokernon-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular matter because the broker does not have discretionary voting power with respect to that matter and has not received instructions from the beneficial owner.

In the event that (i) a quorum is not present at the Meeting; or (ii) a quorum is present but sufficient votes in favor of the position recommended by the Board for a proposal have not been timely received, the chairman of the Meeting may authorize, or the persons named as proxies may propose and vote for, one or more adjournments of the Meeting up to 120 days after the record date, with no other notice than an announcement at the Meeting, in order to permit further solicitation of proxies. Shares represented by proxies indicating a vote contrary to the position recommended by the Board for a proposal will be voted against adjournment of the Meeting.

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Each Fund’s charter (the “Charter”) provides that the Board of Directors be divided into three classes of directors (“Directors”) serving staggered three-year terms and until their successors are elected and qualify.

2

For CEE, the term of office for Directors in Class III expires at the 20152018 Annual Meeting, Class I at the next succeeding annual meeting and Class II at the following succeeding annual meeting. ThreeTwo Class III nominees, Dr. Franz Wilhelm Hopp,Wolfgang Leoni and Mr. Christian H. Strenger and Mr. Joachim Wagner are proposed in this proxy statement for election. If elected, each of the three Class III nominees will serveelection to a three-year term of office until the Annual Meeting of Stockholders in 20182021 and until histheir respective successor issuccessors are elected and qualifies. In addition to the three Class III nominees proposed for election, the Nominating and Governance Committee of the Fund recommended, and all of the current members of the Board of Directors approved,

2

the nomination of Mr. Walter C. Dostmann as an additional Class II Director. If elected, Mr. Dostmann will serve until the Annual Meeting of Stockholders in 2017 and until his successor is elected and qualifies. Robert H. Wadsworth, a Class II Director who has served on CEE’s Board of Directors since 1990, plans to retire from the Board in October 2015.qualify.

For EEA, the term of office for Directors in Class I expires at the 20152018 Annual Meeting, Class II at the next succeeding annual meeting and Class III at the following succeeding annual meeting. ThreeTwo Class I nominees, Dr. Wilhelm Bender Mr. Detlef Bierbaum and Mr. Walter C. Dostmann, are proposed in this proxy statement for election. Mr. Wadsworth,election to a Director in Class I of EEA, who has served on the Fund’s Board of Directors since 1986, is retiring from the Board of EEA and, as a result, is not proposed in this Proxy Statement for election. As a result of Mr. Wadsworth’s retirement from the Board of EEA, the Nominating and Governance Committee has nominated, and all of the current members of the Board of Directors approved, the nomination of Mr. Dostmann to fill the vacancy created by Mr. Wadsworth’s retirement. If elected, each of the three Class I nominees will serve a three-yearyear term of office until the Annual Meeting of Stockholders in 20182021 and until histheir respective successor issuccessors are elected and qualifies.qualify.

For GF, the term of office for Directors in Class III expires at the 20152018 Annual Meeting, Class I at the next succeeding annual meeting and Class II at the following succeeding annual meeting. ThreeTwo Class III nominees, Ambassador Richard R. Burt Dr. Franz Wilhelm Hopp and Dr. Friedbert H. MaltWolfgang Leoni, are proposed in this proxy statement for election. If elected, each of the three Class III nominees will serveelection to a three-year term of office until the Annual Meeting of Stockholders in 20182021 and until histheir respective successor issuccessors are elected and qualifies. In addition to the three Class III nominees proposed for election, the Nominating and Governance Committee of the Fund recommended, and all of the current members of the Board of Directors approved, the nomination of Mr. Walter C. Dostmann as an additional Class I Director. If elected, Mr. Dostmann will serve until the Annual Meeting of Stockholders in 2016 and until his successor is elected and qualifies. Mr. Wadsworth, a Class I Director who has served on GF’s Board of Directors since 1992, plans to retire from the Board in October 2015.qualify.

Should any vacancy occur on a Fund’s Board of Directors, the remaining Directors would be able to fill that vacancy by the affirmative vote of a majority of the remaining Directors in office, even if the remaining Directors do not constitute a quorum. Any Director elected by the Board to fill a vacancy would hold office until the remainder of the full term of the class of Directors in which the vacancy occurred and until a successor is elected and qualifies. If the size of the Board is increased, additional Directors will be apportioned among the three classes to make all classes as nearly equal as possible.

Unless authority is withheld, it is the intention of the persons named in the accompanying Proxy Card(s) to vote the shares represented by each Proxy for the election of the nominees listed above. Each nominee has indicated that he will serve as a Director if elected, but if any nominee should be unable to serve, shares represented by each Proxy will be voted for any other person determined by the persons named in Proxy Card(s) in accordance with their discretion. The Board of Directors has no reason to believe that any of the above nominees will be unable to serve as a Director.

3

BOARDOF DIRECTORS INFORMATION

The management of the business and affairs of each Fund is overseen by the Board of Directors. Directors who are not “interested persons” of a Fund as defined in the Investment Company Act, are referred to as “Independent Directors”, and Directors who are “interested persons” of a Fund are referred to as “Interested Directors”. Certain information concerning the Funds’ governance structure and each Director is set forth below.

Experience, Skills, Attributes, and Qualifications of each Fund’sDirectors. The Nominating and Governance Committee of the Board, which is composed entirely of Independent Directors, reviews the experience, qualifications, attributes and skills of potential candidates for nomination or election by the Board, and conducts a similar review in connection with the proposed nomination of current Directors forre-election by stockholders. When assessing a candidate for nomination it is the policy of the Nominating and Governance Committee to consider, amongst other criteria, whether the individual’s background, skills and experience will complement the background, skills and experience of other nominees and existing

3

independent directors and will contribute to the diversity of the Board. The Nominating and Governance Committee assesses the effectiveness of this policy as part of its annual self assessment.self-assessment. Additional information concerning the Nominating and Governance Committee’s consideration of nominees appears in the description of the Committee following the table below.

The Board has concluded, based on each Director’s experience, qualifications, attributes or skills on an individual basis and in combination with those of the other Directors, that each Director is qualified and should serve or continue to serve as such, if willing. In determining that a particular Director was and continues to be qualified to serve as a Director, the Board has considered a variety of criteria, none of which, in isolation, was controlling. In addition, the Board has taken into account the actual service and commitment of each Director during his tenure (including the Director’s participation in Board and committee meetings, as well as his current and prior leadership of standing and ad hoc committees) in concluding that each should continue to serve. Information about the specific experience, skills, attributes and qualifications of each Director, which in each case led to the Board’s conclusion that the Director should serve or continue to serve as a director of each Fund, is provided in the table following the “Risk Oversight” section below.

The Board believes that, collectively, the Directors have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the Funds and protecting the interests of shareholders.stockholders. Among other attributes common to all Directors are their willingness and ability to commit the necessary time and attention to their duties as Directors, their ability to review critically, evaluate, question and discuss information provided to them (including information requested by the Directors), to interact effectively with each other and with Deutsche Investment Management Americas Inc., the Funds’ administrator (the “Administrator”), Deutsche Asset & Wealth Management International GmbH, the Funds’ investment adviser (the “Investment Adviser”) and other service providers, counsel and the Funds’ independent registered public accounting firm, and to exercise effective business judgment in the performance of their duties as Directors. References to the experience, qualifications, attributes and skills of Directors are pursuant to requirements of the Securities and Exchange Commission, do not constitute holding out of the Board or any Director as having special expertise or experience and shall not be deemed to impose any greater responsibility or liability on any Director or on the Board by reason thereof.

4

Board Structure and Oversight Function. The Board is responsible for oversight of the Funds. Each Fund has engaged the Administrator and the Investment Adviser to manage the Fund on aday-to-day basis. The Board is responsible for overseeing the Administrator and the Investment Adviser and each Fund’s other service providers in the operations of each Fund in accordance with the Fund’s investment objective and policies and otherwise in accordance with the requirements of the Investment Company Act and other applicable Federal and state securities and other laws, and the Fund’s Charter and Bylaws. The Board meets in person at regularly scheduled meetings four times throughout the year. In addition, the Directors may meet in person or by telephone at special meetings or on an informal basis at other times. The Directors also regularly meet outside the presence of any representatives of the Administrator and the Investment Adviser. As described below, the Board has established five standing committees — the Audit, Nominating and Governance, Advisory, Valuation and Executive Committees — and may establish ad hoc committees or working groups from time to time, to assist the Board in fulfilling its oversight responsibilities. Each committee other than the Executive Committee and Valuation Committee

4

comprises only Independent Directors. Each year the Directors evaluate the performance of the Board and its committees. The responsibilities of each committee, including its oversight responsibilities, are described further below. The Independent Directors have also engaged independent legal counsel from time to time, and may from time to time engage consultants and other advisors, to assist them in performing their oversight responsibilities.

The duties of the Chairman of the Board of Directors (the “Chairman”) include setting the agenda for each Board meeting in consultation with management, presiding at each Board meeting, meeting with management between Board meetings, and facilitating communication and coordination between the Directors and management. Mr. Christian Strenger, the Chairman of the Board of Directors, is an Interested Director as defined in the Investment Company Act because he is a member of the Supervisory Board of a company that is affiliated with the Administrator and the Investment Adviser and because of his ownership of shares of the ultimate parent of the Administrator and the Investment Adviser. The Directors believe that it is valuable and appropriate for Mr. Strenger to serve as Chairman and that his service benefits shareholdersstockholders because of his extensive knowledge of the investment management industry, the Deutsche Bank organization and the Funds and because he is a leading corporate governance expert in Germany and internationally. In addition, the Directors note that, although Mr. Strenger is an Interested Director as defined in the Investment Company Act, he is not involved in the management of the Funds and is not an officer or director of the Administrator or the Investment Adviser. The Independent Directors are satisfied that they can act independently and effectively without having an Independent Director serve as Chairman and note that a key structural component for ensuring that they are in a position to do so is for the Independent Directors to constitute a substantial majority of the Board. Mr. Goeltz,Dr. Christopher Pleister, an Independent Director and Chairmanmember of the Advisory Committee, the Audit Committee and the Nominating and Governance Committee, serves as Lead Independent Director for each Fund and as such is available to act as liaison between the Independent Directors and management and to consult with the Chairman to the extent deemed appropriate.

Risk Oversight. Each Fund is subject to a number of risks, including investment, compliance and operational risks.Day-to-day risk management with respect to a Fund resides with the Administrator and the Investment Adviser or other service providers (depending on the nature of the risk), subject to supervision by the Administrator. The Board has charged the Investment Adviser and its affiliates with (i) identifying events or circumstances the occurrence

5

of which could have demonstrable and material adverse effects on a Fund; (ii) to the extent appropriate, reasonable or practicable, implementing processes and controls reasonably designed to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously, and to revise as appropriate, the processes and controls described in (i) and (ii) above.

Risk oversight forms part of the Board’s general oversight of each Fund’s investment program and operations and is addressed as part of various regular Board and committee activities. Each of the Administrator, the Investment Adviser, and the Funds’ other principal service providers has an independent interest in risk management but the policies and the methods by which one or more risk management functions are carried out may differ from a Fund’s and each other’s in the setting of priorities, the resources available or the effectiveness of relevant controls. Oversight of risk management is provided by the Board and the Audit Committee. The Directors regularly receive reports from, among others, management, the Funds’ Chief

5

Compliance Officer, their independent registered public accounting firm, counsel, and internal auditors for the Administrator, as appropriate, regarding risks faced by the Funds and the Administrator’s risk management programs.

Not all risks that may affect a Fund can be identified, and, therefore, controls cannot be developed to eliminate or mitigate their occurrence or effects. The processes and controls employed to address certain risks may be limited in their effectiveness. Also, some risks are simply beyond the reasonable control of the Funds or the Administrator, its affiliates or other service providers. Moreover, it is necessary to bear investment-related risks to achieve each Fund’s goals.

INFORMATION REGARDING DIRECTORS, NOMINEESAND OFFICERS

The following table shows certain information about the nominees for election as Directors and about Directors whose terms will continue, including beneficial ownership of Common Stock of each Fund, and about all officers of each Fund. All current Directors own shares of each Fund.Fund except for Dr. Leoni and Dr. Pleister. Each Fund has elected to be subject to the statutory calculation, notification and publication requirements of the German Investment Tax Act (Investmentsteuergesetz) (the “Act”) for the fiscal year ended October 31, 20142017 for CEE and ended December 31, 20142017 for EEA and GF, and intends to elect to be subject to the Act for its 20152018 fiscal year. Absent this election, Directors who are German residents would be subject to adverse German tax consequences if they owned shares of a fund organized outside of Germany, such as the Funds, that is not subject to German regulation or tax reporting. In light of each Fund’s election to be subject to the Act, the Board of Directors encourages all Directors of each Fund (including those who are German residents) to invest in the Fund.

6

Board Members/Nominees:

Name, Address(1) & Age | Principal Occupation(s) During | Other Directorships | Position(s) with the Time Served, Position(s) | Shares of Common Stock Beneficially Owned at March 31, 2018(4) | ||||

Dr. Wilhelm Bender, | Senior Advisor of Advent International GmbH (private equity) (since 2009) | Continuing Class I Director for CEE since 2013

Nominee as Class I Director for EEA to serve until

Continuing Class II Director for GF since 2013 | CEE:

EEA:

GF: | |||||

|

|

| ||||||

7

Name, Address(1) & Age | Principal Occupation(s) During | Other Directorships | Position(s) with the Time Served, Position(s) | Shares of Common Stock Beneficially Owned at March 31, 2018(4) | ||||

Ambassador Richard R. Burt, | Managing | Director, UBS family of mutual funds (since 1995). | Continuing Class II Director for CEE since 2000

Continuing Class II Director for EEA since 2000

Nominee as Class III Director for GF to serve until | CEE:

EEA:

GF: | ||||

Walter C. Dostmann, | Founder and principal, Dostmann & Partners LLC (international business advisory firm) (2000 to present); |

Nominee for Class I Director for EEA to serve until

| CEE:

EEA:

GF: | |||||

| Continuing Class

Continuing Class III Director for EEA since

Continuing Class II Director for GF since | CEE:

EEA:

GF: | ||||||

8

Name, Address(1) & Age | Principal Occupation(s) During | Other Directorships | Position(s) with the Time Served, Position(s) | Shares of Common Stock Beneficially Owned at March 31, 2018(4) | ||||

| Dr. Christopher Pleister, 69 | Director (nonexecutive) of Depfa Bank plc. (since 2015), Chairman of the Appeal Panel of the Single Resolution Board (Institution of the European Banking Union) since November 2016 (member since 2015). He is the former Chairman of FMSA (German financial market stabilization agency) (2011-2014) and board member 2009-2011), and former Chairman of the Supervisory Board of Deutsche Zentral-Gennossenschaftsbank Frankfurt (2000-2008), former Chairman of BVR (federal association of German cooperative banks) (2000-2008) and Director of Deutsche Gennossenschaftsbank (1990-1999). | Continuing Class I Director for CEE since 2016 Continuing Class II Director for EEA since 2016 Continuing Class II Director for GF since 2016 | CEE: 0 EEA: 0 GF: 0 | |||||

| Interested Directors | ||||||||

Dr.

| Nominee as Class III Director

Continuing Class III Director for EEA since

Nominee as Class III Director |

| ||||||

|

|

| ||||||

|

| CEE:

EEA:

GF: | ||||||

|

|

| ||||||

9

| Interested | ||||||||

Name, Address(1) & Age | Principal Occupation(s) During | Other Directorships | Position(s) with the Time Served, Position(s) | Shares of Common Stock Beneficially Owned at March 31, 2018(4) | ||||

Christian H. Strenger(6), | Member of Supervisory Board (since 1999) and formerly Managing Director (1991-1999) of |

Chairman, Continuing Class I Director for GF since 1990 | CEE:

EEA:

GF: | |||||

| * | The information above includes each Director’s principal occupation during the last five years and other information relating to the experience, attributes and skills relevant to each Director’s/Nominee’s qualifications to serve as a Director, which led (together with the Director’s/Nominee’s current and prior experience as a director of other SEC reporting companies, if any, as indicated elsewhere in the table) to the conclusion that each Director/Nominee should serve as a Director for the Fund. |

| Executive Officers(7) | ||||||||

Name, Address & Age | Position(s) | Length of | Principal Occupation(s) | Shares of Common Stock Beneficially Owned at March 31, 2018(4) | ||||

| Since 2013 | Managing Director | CEE: None

EEA: None

GF: None | |||||

Paul H. Schubert, | Chief Financial Officer and Treasurer | Since 2004 | Managing Director | CEE: None

GF: None | ||||

Caroline Pearson, 56(9)(11) | Chief Legal Officer | Since 2012 | Managing Director(8), DWS, formerly, Secretary, DWS Service Company; and Secretary DWS Distributors, Inc. 2002-2017. | CEE: None EEE: None GF: None | ||||

Scott D. Hogan, 51(11) | Chief Compliance Officer | Since 2016 | Director(8), DWS (since 2013). | CEE: None EEE: None

GF: None | ||||

10

| Executive Officers(7) | ||||||||

Name, Address & Age | Position(s) | Length of | Principal Occupation(s) | Shares of Common Stock Beneficially Owned at March 31, 2018(4) | ||||

|

| |||||||

| Since 2014 | Director |

| |||||

| CEE: None

| |||||||

|

GF: None | |||||||

John Millette, | Secretary | Since 2006 | Director |

| ||||

| CEE: None

EEA: None

GF: None | |||||||

| (1) | The mailing address of all directors with respect to operations of the Funds is c/o Deutsche Investment Management Americas Inc., 345 Park Avenue, New York, New York 10154. |

| (2) | Directorships are for companies |

| (3) | Each current Director oversees 3 funds in the Fund Complex. The Fund Complex includes The Central |

| (4) | As of March 31, |

11

| (5) |

|

| (6) | Indicates “Interested Person”, as defined in the Investment Company Act. Dr. Leoni and Mr. Strenger |

| (7) | The officers of the Funds are elected annually by the Board of Directors at its meeting following the Annual Meeting of Stockholders. Each of Mr. |

| (8) |

|

Executive title, not a board directorship. |

11

Indicates ownership of securities of Deutsche Bank AG either directly or through Deutsche Bank’s deferred compensation plan. |

Address: 60 Wall Street, New York, New York 10005. |

Address: One |

|

Mr. Millette has served as Secretary since January 1, 2011. He served as Assistant Secretary from July 14, 2006 to December 31, 2010 and as Secretary to the Funds from January 30, 2006 to July 13, 2006. |

| (13) | Address: 345 Park Avenue, New York, New York, 10154 |

| (14) | Ms. Uzcan has served as Assistant Secretary since July 22, 2013 and served as President since December 1, 2017. |

The following table contains additional information with respect to the beneficial ownership of equity securities by each Director in each Fund and, on an aggregated basis, in any registered investment companies overseen by the Director within the same Family of Investment Companies as the Fund:

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

Name of Director | CEE — Dollar Range of Equity Securities in the Fund(1) | EEA — Dollar Range of Equity Securities in the Fund(1) | GF — Dollar Range of Equity Securities in the Fund(1) | Aggregate Dollar Range of Equity Securities in All Funds Overseen by Director in Family of Investment Companies(1),(2) | ||||

Dr. Wilhelm Bender | $0-$10,000 | $0-$10,000 | $0-$10,000 | $10,001-$50,000 | ||||

Ambassador Richard R. Burt | $10,001-$50,000 | $10,001-$50,000 | $50,001-$100,000 | $50,001-$100,000 | ||||

Walter C. Dostmann | $10,001-$50,000 | $10,001-$50,000 | $10,001-$50,000 | $10,001-$50,000 | ||||

Dr. Kenneth C. Froewiss | $10,001-$50,000 | $10,001-$50,000 | $10,001-$50,000 | $10,001-$50,000 | ||||

Dr. Wolfgang Leoni | $0 | $0 | $0 | $0 | ||||

Dr. Christopher Pleister | $0 | $0 | $0 | $0 | ||||

Christian H. Strenger | $10,001-$50,000 | $10,001-$50,000 | $10,001-$50,000 | $50,001-$100,000 |

| (1) | Valuation date is March 31, |

| (2) | The Family of Investment Companies consists of The Central |

12

The Board of Directors currently has five standing committees including an audit committee (the “Audit Committee”), an advisory committee (the “Advisory Committee”), an executive committee (the “Executive Committee”), a nominating and governance committee (the “Nominating Committee”) and a valuation committee (the “Valuation Committee”). As none of the Fundsneither Fund has employees, the Board of Directors has not established a compensation committee.

The Audit Committee, currently comprising Messrs.Ambassador Burt, GoeltzMr. Dostmann (Chair), Wadsworth and WagnerDrs. Froewiss and Dr. Malt,Pleister, operates pursuant to a written charter which is available on the Funds’ website, deutschefunds.com/https://dws.com/EN/docs/products/Germany-Funds-Audit-Committee-Charter.pdf. The Audit Committee’s organization and responsibilities are contained in the Audit Committee Report, which is included in this Proxy Statement, and in its written charter. The members of the Audit Committee are “independent” as required by the independence standards ofRule 10A-3 under the Securities Exchange Act of 1934. The Board of Directors has determined that each member of the Audit Committee is financially literate and has determined that Messrs. Goeltz, WadsworthMr. Dostmann and WagnerDr. Froewiss meet the requirements for an audit committee financial expert under the rules of the Securities and Exchange Commission (“SEC”). Although the

12

Board has determined that all threeMr. Dostmann and Dr. Froewiss meet the requirements for an audit committee financial expert, their responsibilities are the same as those of the other audit committee members. Messrs. Goeltz, WadsworthMr. Dostmann and WagnerDr. Froewiss are not auditors or accountants, do not perform “field work” and are not full-time employees. The SEC has stated: (i) that an audit committee member who is designated as an audit committee financial expert will not be deemed to be an “expert” for any purpose as a result of being identified as an audit committee financial expert; and (ii) that the designation or identification of a person as an audit committee financial expert does not: (A) impose on such person any duties, obligations, or liabilities that are greater than those imposed on such persons as members of the audit committee or board of directors in the absence of such designation or identification; or (B) affect the duties, obligations, or liability of any other member of the audit committee or the board of directors. The Audit Committee met four times during each Fund’s fiscal year ending in 2014.2017.

The Advisory Committee, currently comprising Messrs. Bierbaum, GoeltzAmbassador Burt and WadsworthMr. Dostmann (Chair) and Dr. Malt,Pleister, makes recommendations to the full Board with respect to the Administration Agreement between each Fund and Deutsche Investment Management Americas Inc., and the Investment Advisory Agreement between each Fund and Deutsche Asset & Wealth Management International GmbH. The Advisory Committee met threetwo times during each Fund’s past fiscal year.

The Executive Committee, currently comprising Messrs.Ambassador Burt Goeltz,and Dr. Leoni and Mr. Strenger, and Wadsworth, has the authority to act for the Board on all matters between meetings of the Board subject to any limitations under applicable state law. DuringThe Executive Committee did not meet during each Fund’s past fiscal year the Executive Committee did not meet.year.

The Valuation Committee, currently comprising Messrs. WadsworthDrs. Bender and Leoni (Chair) and Wagner and Dr. Malt,, reviews each Fund’s valuation procedures and makes recommendations with respect thereto and, to the extent required by such procedures, determines the fair value of the Fund’s securities or other assets. The Valuation Committee met two timesone time during each Fund’s past fiscal year.

The Nominating and Governance Committee, currently comprising Messrs.Ambassador Burt (Deputy Chair), Goeltz and Drs. Froewiss (Chair), Wadsworth, Wagner and Dr. Malt,Pleister, operates pursuant to a written

13

charter which is available on the Funds’ website, deutschefunds.com/https://dws.com/EN/docs/products/Germany-Master-Nominating-Committee-Charter.pdf. The Board has determined that each of the members of the Nominating and Governance Committee is not an “interested person” as the term is defined in Section 2(a)(19) of the Investment Company Act. Generally, the Nominating and Governance Committee identifies, evaluates and selects and nominates, or recommends to the Board of Directors, candidates for the Board or any committee of the Board, and also advises the Board regarding governance matters generally and confirms that the Board and Audit Committee undertake annual self-evaluations. To be eligible for nomination as a Director a person must, at the time of such person’s nomination, have Relevant Experience and Country Knowledge and must not have any Conflict of Interest, as those terms are defined in the Fund’s Bylaws. The relevant portions of each Fund’s Bylaws describing these requirements are included as Annex A. The Nominating and Governance Committee may also take into account additional factors listed in the Nominating and Governance Committee Charter, which generally relate to the nominee’s industry knowledge, business experience, education, ethical reputation, special skills, ability to work well in group settings and the ability to qualify as an “independent director”. When assessing a candidate for nomination, the Nominating and

13

Governance Committee considers whether the individual’s background, skills and experience will complement the background, skills and experience of other nominees and will contribute to the diversity of the Board.

The Nominating and Governance Committee will consider nominee candidates properly submitted by stockholders in accordance with applicable law, each Fund’s Charter or Bylaws, resolutions of the Board and the qualifications and procedures set forth in the Nominating and Governance Committee Charter, which is available on the Funds’ website at the website address noted above. A stockholder or group of stockholders seeking to submit a nominee candidate for any Fund (i) must have beneficially owned at least 1% of the Fund’s common stock for at least two years, (ii) may submit only one nominee candidate for any particular meeting of stockholders, and (iii) may submit a nominee candidate for only an annual meeting or other meeting of stockholders at which directors will be elected. The stockholder or group of stockholders must provide notice of the proposed nominee pursuant to the requirements found in the relevant Fund’s Bylaws. Generally, this notice must be received not less than 120 days nor more than 150 days prior to the first anniversary of the date of mailing of the notice for the preceding year’s annual meeting. Such notice shall include the specific information required by the Fund’s Bylaws. The relevant portions describing these requirements also are included as Annex A. The Nominating and Governance Committee will evaluate nominee candidates properly submitted by stockholders on the same basis as it considers and evaluates candidates recommended by other sources. The Nominating and Governance Committee met two times during each Fund’s past fiscal year.

In accordance with its charter, the Nominating and Governance Committee reviews each Director’s affiliations and relationships for purposes of determining whether or not the Director qualifies as an “independent director”. The Nominating and Governance Committee also considers each Director’s independence more generally, as well as various governance “best practices”, including the suggestion of anon-U.S. corporate governance code that a board of directors should state its reasons if it determines that a director is independent notwithstanding that the director has served for more than nine years from the date of his first election.

The Nominating and Governance Committee has concluded that each Director other than the Chairman of the Board is an “independent director”, and that it was satisfied that: (i) those

14

independent Directors who have served for more than nine years continue to be independent in character and judgment; (ii) the experience of such Directors with each Fund permits them to make extremely valuable contributions to the functioning of the Board; and (iii) the views of such Directors are not “entrenched” as a result of the length of service to the Funds. The Nominating and Governance Committee based its conclusion, in part, on its observation that such Directors regularly demonstrate their independence by their questioning and challenging of management at and between Board meetings. The Nominating and Governance Committee also noted that none of the Directors or nominees for Director currently serves on the board of more than three registered investment companies advised by the investment adviser. The Nominating and Governance Committee also believes that the receipt of compensation for service as a Director does not adversely affect the independence of any Director’s character and judgment and notes that fund industry “best practices” encourage service on multiple boards.

All members on each of the five committees of the Board are not “interested persons” as the term is defined in the Investment Company Act, with the exception of Mr. Strenger, who is a member of the Executive Committee and Dr. Leoni, who is a member of the Executive Committee and Valuation Committee.

14

During each Fund’s past fiscal year, the Board of Directors had four regular meetings and, for CEE, one special telephonic meeting.meetings. During each Fund’s past fiscal year, the Board of Directors had four regular meetings. Each incumbent Director who served as a Director during the past fiscal year attended at least 75% of the aggregate number of meetings of the Board. Each incumbent Director who served on one or more Board Committees during the past fiscal year attended at least 75% of the aggregate number of meetings of the relevant Committees, with the following exceptions: Mr. Burt attended 50% of the meetings of the Audit Committee of CEE and of the respective Committees on which he served, except for Ambassador Burt whose total attendance was less than 75%. Ambassador Burt was unable to attend two Board meetings, as well as the Committee meetings held in connection with such Board meetings, because of a family emergency in one case, and an unforeseen schedule conflict in the Nominatingother case. He has attended all Board and Governance Committee meetings for Committees on which he serves that have taken place to date in 2018, and expects to attend all remaining meetings in 2018. In addition, he attended 100% of each Fund; Mr. Malt attended 50% of the meetings of the Valuation Committee of CEE; Mr. Wagner attended 50% of the meetings of the Valuation Committee of each of CEEGF and EEA Board and he did not attend the sole meetingapplicable Committee meetings in fiscal 2016, and 90% of the ValuationBoard and applicable Committee of GF. The Board has a policy that encourages Directors to attend the Annual Meeting of Stockholders, to the extent that travel to the Annual Meeting of Stockholders is reasonablemeetings for that Director. Three Directors attended the 2014 Annual Meeting of Stockholders.CEE in fiscal 2016.

To communicate with the Board of Directors or an individual Director of a Fund, a stockholder must send a written communication to the Fund’s Secretary at One Beacon Street,International Place, Boston, MA 0210802110 (c/o the relevant Fund), addressed to (i) the Board of Directors of the Fund or an individual Director, and (ii) the Secretary of the Fund. The Secretary of the Fund will direct the correspondence to the appropriate parties.

Each Fund pays each of its Directors who is not an interested person of the Fund, of the Investment Adviser or of the Administrator an annual fee of $6,667$8,000 plus $917$1,167 for each Board meeting and $750$917 for each Committee meeting attended ($500 for attendance at Advisory Committee meetings for Directors who are not members of the Committee). Each Fund reimburses the Directors (except for those employed by the Deutsche Bank Group) for travel expenses in connection with Board meetings. The Chairman of the Audit Committee, Advisory Committee, and Nominating and Governance Committee each receives an additional $1,000 annual retainer per Fund of $4,000, $3,000 and $3,000, respectively. The Lead Independent Director also receives an additional annual retainer of $2,000 per Fund. None of the Funds provides compensation in the form of pension or other retirement benefits to any of the Directors. Currently, the Funds, together with 10787 other open- andclosed-end funds advised by wholly owned entities of the Deutsche Bank Group in the United States, represent the entire Fund Complex within the meaning of the applicable rules and regulations of the SEC.

15

The following table sets forth (a) the aggregate compensation from each Fund for the fiscal year ended October 31, 20142017 for CEE and December 31, 20142017 for EEA and GF, and (b) the total compensation from the Fund Complex for the 20142017 calendar year, (i) for each Director who is not an interested person of the Funds, and (ii) for all such Directors as a group.

Name of Director | CEE — Aggregate Compensation from Fund | EEA — Aggregate Compensation from Fund | GF — Aggregate Compensation from Fund | Total Compensation from Fund Complex | ||||||||||||

Dr. Wilhelm Bender | $ | 12,252 | $ | 11,335 | $ | 11,330 | $ | 34,917 | ||||||||

Detlef Bierbaum | $ | 12,750 | $ | 11,834 | $ | 11,832 | $ | 36,416 | ||||||||

Ambassador Richard R. Burt | $ | 12,080 | $ | 12,835 | $ | 12,835 | $ | 37,750 | ||||||||

Walter Dostmann | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

Richard Karl Goeltz | $ | 16,496 | $ | 15,584 | $ | 15,858 | $ | 47,666 | ||||||||

Dr. Franz Wilhelm Hopp | $ | 12,250 | $ | 11,332 | $ | 11,335 | $ | 34,917 | ||||||||

Dr. Friedbert H. Malt | $ | 16,250 | $ | 14,581 | $ | 14,858 | $ | 45,417 | ||||||||

Robert H. Wadsworth | $ | 15,330 | $ | 14,417 | $ | 13,668 | $ | 318,416 | (1) | |||||||

Joachim Wagner | $ | 15,168 | $ | 14,252 | $ | 13,498 | $ | 42,917 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Total | $ | 112,576 | $ | 106,170 | $ | 104,668 | $ | 598,416 | ||||||||

Name of Director | CEE — Aggregate Compensation from Fund | EEA — Aggregate Compensation from Fund | GF — Aggregate Compensation from Fund | Total Compensation from Fund Complex | ||||||||||||

Dr. Wilhelm Bender | $ | 11,883 | $ | 4,937 | $ | 17,982 | $ | 34,742 | ||||||||

Ambassador Richard R. Burt | $ | 12,337 | $ | 4,157 | $ | 15,074 | $ | 31,568 | ||||||||

Walter Dostmann | $ | 14,712 | $ | 5,519 | $ | 20,024 | $ | 40,255 | ||||||||

Dr. Kenneth C. Froewiss(1) | $ | 1,219 | $ | 2,528 | $ | 9,351 | $ | 303,099 | ||||||||

Dr. Wolfgang Leoni(2) | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

Dr. Christopher Pleister | $ | 7,303 | $ | 4,821 | $ | 17,517 | $ | 29,641 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Total | $ | 47,394 | $ | 21,962 | $ | 79,949 | $ | 439,306 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) |

|

| (2) | Dr. Leoni became a Director of each Fund on June 27, 2017. |

15

No compensation is paid by a Fund to Directors who are interested persons of the Fund or of any entity of the Deutsche Bank Group or to officers.

THE BOARD OF EACH FUND UNANIMOUSLY RECOMMENDS A VOTEFOR PROPOSAL NO. 1.

Required Vote. Provided a quorum has been established, for each Fund the affirmative vote of a majority of the votes entitled to be cast at the Meeting is required for the election of each Director. For purposes of the election of Directors, abstentions and brokernon-votes will have the same effect as a vote against a Director.

PROPOSAL NO. 2:

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee has approved PricewaterhouseCoopers LLP (“PwC”), an independent registered public accounting firm, as independent auditors for CEE for the fiscal year ending October 31, 2015,2018 and for EEA for the fiscal year ending December 31, 2015 and for GF for the fiscal year ending December 31, 2015.2018. A majority of the members of the Board of Directors, including a majority of the members of the Board of Directors who are not “interested” Directors (as defined in the Investment Company Act) of each Fund, have ratified the appointment of PwC as the Fund’s independent auditors for that fiscal year. PwC, or a predecessor firm, has served as the independent auditors for each Fund since inception.

Neither the Charter nor Bylaws of any Fund requires that the stockholders ratify the appointment of PwC as the Fund’s independent auditors. We are doing so because we believe it is a matter of good corporate practice. If the stockholders do not ratify the appointment, the Audit Committee and the Board of Directors will reconsider whether to retain PwC, but may

16

retain such independent auditors. Even if the appointment is ratified, the Audit Committee and the Board of Directors in their discretion may change the appointment at any time during the year if they determine that such change would be in the best interests of a Fund and its stockholders. It is intended that the persons named in the accompanying Proxy Card(s) will vote for PwC. A representative of PwC will be present at the Meeting, will have the opportunity to make a statement and is expected to be available to answer appropriate questions concerning each Fund’s financial statements.

THE BOARD OF EACH FUND UNANIMOUSLY RECOMMENDS

A VOTEFOR PROPOSAL NO. 2.

Required Vote. Provided a quorum has been established, the affirmative vote of a majority of the votes cast at the Meeting is required for the ratification of the appointment by the Audit Committee and the Board of Directors of PwC as independent auditors for each Fund for its 20152018 fiscal year. For purposes of Proposal No. 2, abstentions and brokernon-votes will have no effect on the result of the vote.

INFORMATION WITH RESPECT TO THE FUNDS’ INDEPENDENT AUDITORS

The following tables show fees paid to PwC by each Fund during the Fund’s two most recent fiscal years: (i) for audit andnon-audit services provided to the Fund, and (ii) for

16

engagements fornon-audit servicespre-approved by the Audit Committee for the Fund’s Investment Adviser and Administrator and certain entities controlling, controlled by, or under common control with the Investment Adviser and Administrator that provide ongoing services to the Fund (collectively, the “Adviser Entities”), which engagements relate directly to the operations and financial reporting of the Fund. The Audit Committee of each board reviews, at least annually, whether PwC’s receipt ofnon-audit fees from each Fund, each Fund’s Investment Adviser, each Fund’s Administrator and all Adviser Entities is compatible with maintaining PwC’s independence.

The Central Europe, Russia and TurkeyEastern Europe Fund, Inc.:

| Audit Fees(1) | Audit Related Fees(2) | Tax Fees(3) | All Other Fees(4) | |||||||||||||||||||||||||

Fiscal Year | Fund | Fund | Adviser Entities | Fund | Adviser Entities | Fund | Adviser Entities | |||||||||||||||||||||

2014 | $ | 79,100 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 6,200 | $ | 0 | ||||||||||||||

2013 | $ | 87,500 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 6,200 | $ | 0 | ||||||||||||||

| Audit Fees(1) | Audit Related Fees(2) | Tax Fees(3) | All Other Fees(4) | |||||||||||||||||||||||||

Fiscal Year | Fund | Fund | Adviser Entities | Fund | Adviser Entities | Fund | Adviser Entities | |||||||||||||||||||||

2017 | $ | 75,600 | $ | 0 | $ | 0 | $ | 5,278 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||||

2016 | $ | 74,100 | $ | 0 | $ | 0 | $ | 5,348 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||||

The European Equity Fund, Inc.:

| Audit Fees(1) | Audit Related Fees(2) | Tax Fees(3) | All Other Fees(4) | |||||||||||||||||||||||||

Fiscal Year | Fund | Fund | Adviser Entities | Fund | Adviser Entities | Fund | Adviser Entities | |||||||||||||||||||||

2014 | $ | 66,100 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 6,355 | $ | 0 | ||||||||||||||

2013 | $ | 58,500 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 5,900 | $ | 0 | ||||||||||||||

17

| Audit Fees(1) | Audit Related Fees(2) | Tax Fees(3) | All Other Fees(4) | |||||||||||||||||||||||||

Fiscal Year | Fund | Fund | Adviser Entities | Fund | Adviser Entities | Fund | Adviser Entities | |||||||||||||||||||||

2017 | $ | 62,600 | $ | 0 | $ | 0 | $ | 5,343 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||||

2016 | $ | 61,100 | $ | 0 | $ | 0 | $ | 5,395 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||||

The New Germany Fund, Inc.:

| Audit Fees(1) | Audit Related Fees(2) | Tax Fees(3) | All Other Fees(4) | |||||||||||||||||||||||||

Fiscal Year | Fund | Fund | Adviser Entities | Fund | Adviser Entities | Fund | Adviser Entities | |||||||||||||||||||||

2014 | $ | 70,000 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 6,355 | $ | 0 | ||||||||||||||

2013 | $ | 65,000 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 5,900 | $ | 0 | ||||||||||||||

| Audit Fees(1) | Audit Related Fees(2) | Tax Fees(3) | All Other Fees(4) | |||||||||||||||||||||||||

Fiscal Year | Fund | Fund | Adviser Entities | Fund | Adviser Entities | Fund | Adviser Entities | |||||||||||||||||||||

2017 | $ | 75,600 | $ | 0 | $ | 0 | $ | 5,343 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||||

2016 | $ | 74,100 | $ | 0 | $ | 0 | $ | 5,395 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||||

| (1) | “Audit Fees” are the aggregate fees billed for professional services for the audit of each Fund’s annual financial statements and services provided in connection with statutory and regulatory filings or engagements. |

| (2) | “Audit Related Fees” are the aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of financial statements and are not reported under “Audit Fees”. |

| (3) | “Tax Fees” are the aggregate fees billed for services associated with foreign tax filings. |

| (4) | “All Other Fees” are the aggregate fees billed for products and services other than “Audit Fees”, “Audit Related Fees” and “Tax Fees”. |

Audit CommitteePre-Approval Policies and Procedures. Generally, the Audit Committee mustpre-approve (i) all services to be performed for each Fund by the Fund’s independent auditors and (ii) allnon-audit services to be performed by each Fund’s independent auditors for the Fund’s Investment Adviser or any Adviser Entities with respect to operations and financial reporting of the Fund, and all of the engagements reflected in the table above werepre-approved by the Audit Committee. Any member of the Audit Committee maypre-approve any audit ornon-audit services to be performed by the independent auditors, provided that any

17

such approvals are presented to the Audit Committee at its next scheduled meeting. The auditors shall report to the Audit Committee at each of its regular meetings all audit ornon-audit services to each Fund and allnon-audit services to the Adviser Entities that relate directly to the Fund’s operations and financial reporting initiated since the last such report was rendered, including a general description of the services and projected fees and the means by which such services were approved by the Audit Committee.

AllNon-Audit Fees. The tables below show the aggregatenon-audit fees billed by PwC for services rendered to each Fund and to the Adviser Entities that provide ongoing services to the Fund, whether or not such engagements relate directly to the operations and financial reporting of the Fund, for the two most recent fiscal years for each Fund.

The Central Europe, Russia and TurkeyEastern Europe Fund, Inc.:

Fiscal Year | Aggregate Non-Audit Fees | |||

2014 | $ | 69,639 | ||

2013 | $ | 72,735 | ||

Fiscal Year | Aggregate Non-Audit Fees | |||

2017 | $ | 5,278 | ||

2016 | $ | 5,348 | ||

The European Equity Fund, Inc.:

Fiscal Year | Aggregate Non-Audit Fees | |||

2014 | $ | 69,794 | ||

2013 | $ | 72,435 | ||

18

Fiscal Year | Aggregate Non-Audit Fees | |||

2017 | $ | 5,343 | ||

2016 | $ | 5,395 | ||

The New Germany Fund, Inc.:

Fiscal Year | Aggregate Non-Audit Fees | |||

2014 | $ | 69,794 | ||

2013 | $ | 72,435 | ||

Fiscal Year | Aggregate Non-Audit Fees | |||

2017 | $ | 5,343 | ||

2016 | $ | 5,395 | ||

There were no amounts that were approved by the Audit Committee pursuant to the de minimis exception under Rule2-01 of RegulationS-X.

According to each Fund’s principal Independent Registered Public Accounting Firm, substantially all of the principal Independent Registered Public Accounting Firm’s hours spent on auditing the Fund’s financial statements were attributed to work performed by full-time permanent employees of the principal Independent Registered Public Accounting Firm.

In connection with the audit of the 2016 and 2017 financial statements, each Fund entered into an engagement letter with PwC. The terms of the engagement letter required by PwC, and agreed to by each Fund’s Audit Committee, include a provision mandating the use of mediation and arbitration to resolve any controversy or claim between the parties arising out of or relating to the engagement letter or the services provided there-under.

For each Fund, in a letter provided to the Audit Committee pursuant to PCAOB Rule 3526 and dated September 30, 2016, PwC informed the Audit Committee that PwC had identified circumstances where PwC maintains lending relationships with owners of greater than 10% of the shares of certain investment companies within the “investment company complex” as defined under Rule2-01(f)(14) of RegulationS-X. PwC informed the Audit Committee that these lending relationships are inconsistent with the SEC Staff’s interpretation ofRule 2-01(c)(l)(ii)(A) of RegulationS-X (referred to as the “Loan Rule”).

18

The Loan Rule specifically provides that an accounting firm would not be independent if it receives a loan from a lender that is a record or beneficial owner of more than ten percent of an audit client’s equity securities. For purposes of the Loan Rule, audit clients include the Funds as well as all registered investment companies advised by the Investment Adviser and its affiliates, including other subsidiaries of the Adviser’s parent company, Deutsche Bank AG (collectively, the “Deutsche Funds Complex”). PwC’s lending relationships affect the analysis of PwC’s independence under the SEC Staff’s interpretation of the Loan Rule with respect to all investment companies in the Deutsche Funds Complex.

For each Fund, in its September 30, 2016 letter, PwC affirmed to the Audit Committee that, as of the date of the letter, PwC is an independent accountant with respect to the Funds, within the meaning of PCAOB Rule 3520. In its letter, PwC also informed the Audit Committee that, after evaluating the facts and circumstances and the applicable independence rules, PwC has concluded that with regard to its compliance with the independence criteria set forth in the rules and regulations of the SEC related to the Loan Rule, it believes that it remains objective and impartial despite matters that may ultimately be determined to be inconsistent with these criteria and therefore it can continue to serve as the Funds’ registered public accounting firm. PwC informed the Audit Committee that its conclusion was based on a number of factors, including, among others, PwC’s belief that the lenders are not able to impact the impartiality of PwC or assert any influence over the investment companies in the Deutsche Funds Complex whose shares the lenders own or the applicable investment company’s investment adviser; and the lenders receive no direct benefit from their ownership of the investment companies in the Deutsche Funds Complex in separate accounts maintained on behalf of their insurance contract holders. In addition, the individuals at PwC who arranged PwC’s lending relationships have no oversight of, or ability to influence, the individuals at PwC who conducted the audits of the Funds’ financial statements.

On June 20, 2016, the SEC Staff issued a“no-action” letter to another mutual fund complex (see Fidelity Management & Research Company et al.,No-Action Letter) related to similar Loan Rule issues as those described above. In that letter, the SEC Staff confirmed that it would not recommend enforcement action against an investment company that relied on the audit services performed by an audit firm that was not in compliance with the Loan Rule in certain specified circumstances. The circumstances described in theno-action letter appear to be substantially similar to the circumstances that affected the analysis of PwC’s independence under the Loan Rule with respect to the Funds. PwC confirmed to the Audit Committee that it meets the conditions of theno-action letter. In theno-action letter, the SEC Staff stated that the relief under the letter is temporary and will expire 18 months after the issuance of the letter.

For each Fund, in a letter provided to the Audit Committee pursuant to PCAOB Rule 3526 and dated January 12, 2018, PwC informed the Audit Committee that PwC had identified circumstances where (1) a covered person within PwC that providednon-audit services to an entity within the “investment company complex” as defined under Rule2-01(f)(14) of RegulationS-X maintained a financial relationship with an investment company within the investment company complex in contradiction of Rule2-01(c)(1)(i)(A) of RegulationS-X and (2) PwC maintains lending relationships with owners of greater than 10% of the shares of certain investment companies within the investment company complex that are inconsistent with the Loan Rule.

19

Covered Person Matter: For each Fund, in its January 12, 2018 letter, PwC advised the Audit Committee that after consideration of the facts and circumstances and the applicable independence rules, PwC concluded that a reasonable investor with knowledge of all relevant facts and circumstances would conclude that PwC is capable of exercising objective and impartial judgment on all issues encompassed within its audit of the financial statements of the Fund. In the letter, PwC also affirmed to the Audit Committee that, as of the date of the letter, PwC is an independent accountant with respect to the Fund, within the meaning of PCAOB Rule 3520. In assessing this matter, PwC indicated that, upon detection of the breach, the PwC covered person was removed from thenon-audit engagement and that, among other things, the breach (i) did not relate to financial relationships directly in the Fund, (ii) did not involve a professional who was part of the audit engagement team for the Fund or in a position to influence the audit engagement team, (iii) involved a professional whosenon-audit services were not and will not be utilized or relied upon by the audit engagement team in the audit of the financial statements of the Fund and (iv) involved a professional that did not provide any consultation to the audit engagement team of the Fund.

Loan Rule Matter: For each Fund, in its January 12, 2018 letter, PwC affirmed to the Audit Committee that, as of the date of the letter, PwC is an independent accountant with respect to the Fund, within the meaning of PCAOB Rule 3520. In its letter, PwC also informed the Audit Committee that PwC has concluded that with regard to its compliance with the independence criteria set out in the rules and regulations of the SEC related to the Loan Rule, it believes that it remains objective and impartial despite matters that may ultimately be determined to be inconsistent with these criteria, and therefore it can continue to serve as the Fund’s independent registered public accounting firm. PwC informed the Audit Committee that its conclusion was based on a number of factors, including, among others, (i) PwC’s belief that it is unlikely the lenders would have any interest in the outcome of the audit of the Fund and therefore would not seek to influence the outcome of the audit, (ii) no third party made an attempt to influence the outcome of the audit of the Fund and even if an attempt was made, PwC professionals are required to disclose any relationships that may raise issues about objectivity, confidentiality, independence, conflicts of interest or favoritism, and (iii) the lenders typically lack influence over the investment adviser, who controls the management of the Fund.

As noted above, on June 20, 2016, the SEC Staff issued a“no-action” letter to another mutual fund complex (see Fidelity Management & Research Company et al.,No-Action Letter) related to similar Loan Rule issues as those described above. In that letter, the SEC Staff confirmed that it would not recommend enforcement action against an investment company that relied on the audit services performed by an audit firm that was not in compliance with the Loan Rule in certain specified circumstances. The circumstances described in theno-action letter appear to be substantially similar to the circumstances that affected PwC’s independence under the Loan Rule with respect to the Fund. PwC represented that it has complied with PCAOB Rule 3526(b)(1) and (2), which are conditions to the Fund relying on the no action letter, and affirmed that it is an independent accountant within the meaning of PCAOB Rule 3520.

AUDIT COMMITTEE REPORT

The purposes of the Audit Committee are: (1) to assist the Board of Directors in its oversight of (i) the integrity of each Fund’s financial statements; (ii) each Fund’s compliance with

20

legal and regulatory requirements; (iii) the independent auditors’ qualifications and independence; and (iv) the performance of the independent auditors; and (2) to prepare this report. The Audit Committee assists the Board of Directors in its oversight of each Fund’s policies and practices with respect to accounting, financial reporting, internal control over financial reporting, independent audits, and risk management. The Audit Committee regularly discusses each Fund’s most significant risk exposures and the steps management has taken to monitor and control such exposures. Each Member of the Audit Committee is “independent,” as required by the independence standards ofRule 10A-3 under the Securities Exchange Act of 1934. The Audit Committee operates pursuant to a written charter. As set forth in the Audit Committee Charter, management of each Fund and applicable service providers are responsible for the preparation, presentation and integrity of the Fund’s financial statements and for the effectiveness of internal control over financial reporting. Management and applicable service providers are responsible for maintaining appropriate accounting and financial reporting principles and policies and internal control over financial reporting and other procedures that provide for compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for planning and carrying out a proper audit of each Fund’s annual financial statements and expressing an opinion as to their conformity with generally accepted accounting principles.

In the performance of its oversight function, the Audit Committee has considered and discussed the audited financial statements with management and the independent auditors of each Fund. The Audit Committee has also discussed with the independent auditors the matters required to be discussed by Public Company Accounting Oversight Board Rule 3526 (Communication with Audit Committees Concerning Independence), as currently in effect. The Audit Committee has also considered whether the provision of anynon-audit services notpre-approved by the Audit Committee provided by the Funds’ independent auditors to the Funds’ investment adviser, administrator or to any entity controlling, controlled by or under common control with the Funds’ investment adviser or administrator that provides ongoing services to the Funds is compatible with maintaining the auditors’ independence. During the past fiscal year, nonon-audit services that were notpre-approved by the Audit Committee were provided by the Funds’ independent auditors. Finally, the Audit Committee has received the written disclosures and the letter from the independent auditors required by Public Company Accounting Oversight Board Rule 3526, Communication with Audit Committees Concerning Independence, as currently in effect, and has discussed with the auditors their independence. Each Fund’s Audit Committee also discussed with the independent auditors the matters required to be discussed by Auditing Standard No. 16 (Communications With Audit Committees).

The members of the Audit Committee are not full-time employees of the Funds and are not performing the functions of auditors or accountants. As such, it is not the duty or responsibility of the Audit Committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures or to set auditor independence standards. Members of the

19

Audit Committee necessarily rely on the information provided to them by management and the independent auditors. Accordingly, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of each Fund’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that the Funds’ auditors are in fact “independent”.

21

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee referred to above and in the Charter, the Audit Committee recommended to the Board of Directors of each Fund that the audited financial statements of each Fund be included in each Fund’s annual report to stockholders for the fiscal year ended October 31, 20142017 for CEE and December 31, 20142017 for EEA and December 31, 2014 for GF.

Submitted by the Audit Committee

of each Fund’s Board of Directors

Richard Karl Goeltz, ChairWalter C. Dostmann, Chairman

Richard R. Burt

Dr. Friedbert MaltKenneth C. Froewiss

Robert H. WadsworthChristopher Pleister

Joachim Wagner

PROPOSAL 3 — EEA ONLY

STOCKHOLDER PROPOSAL REGARDING BOARD DECLASSIFICATION

If properly presented for consideration at the Meeting, Proposal 3 will allow stockholders of EEA to vote on a proposal by a stockholder asking the Fund to take steps to declassify the Board of Directors of the Fund.

A beneficial owner (the “Proponent”) of Common Stock of the Fund has informed the Fund that he intends to present the following proposal to stockholders for action at the Meeting. The proponent’s name and address and the number of shares owned by him will be furnished by the Secretary of the Fund upon request. The Proponent’s supporting statement for his proposal, which includes a statement that is factually incorrect, appears immediately after the proposal.

“RESOLVED, shareholders ask that our Company take the steps necessary to reorganize the Board of Directors into one class with each director subject to election each year. Although our company can adopt this proposal topic in one-year and the proponent is in favor of a one-year implementation, this proposal allows the option to phase it in over3-years.”

STOCKHOLDER’S SUPPORTING STATEMENT

“Arthur Levitt, former Chairman of the Securities and Exchange Commission said, “In my view it’s best for the investor if the entire board is elected once a year. Without annual election of each director shareholders have far less control over who represents them.”

20

“A total of 79 S&P 500 and Fortune 500 companies, with aggregate market capitalization of one trillion dollars, adopted this topic in 2012 and 2013. Annual elections are widely viewed as a corporate governance best practice. Annual election of each director could make directors more accountable, and thereby contribute to improved performance and increased company value.”

“We previously approve this proposal topic with our impressive 68% support.”

“Please vote to enhance value.”

Elect Each Director Annually — Proposal 4”

End of Proposal and Supporting Statement

For the reasons discussed below your Board of Directors unanimously opposes this Proposal and strongly urges all stockholders to voteAGAINST Proposal 3 on the Proxy Card. Please read carefully the discussion below.

OPPOSING STATEMENT OF YOUR BOARD OF DIRECTORS

The Fund’s Board has carefully considered the stockholder proposal and the arguments for and against a classified board. The Board continues to believe that a classified board structure is in the best interests of the Fund and its stockholders and opposes the stockholder proposal for the reasons discussed below.The Board also notes that the second last sentence of the Proponent’s supporting statement is factually incorrect as his proposal has not been voted upon by the Fund’s stockholders in the past. The sentence may reflect just a markup of a proposal made by the Proponent to another company.

The Fund’s Articles of Incorporation and Bylaws currently provide for the Directors to be classified into three classes, and the Directors of each class are elected to hold office for a term expiring at the annual meeting of stockholders held in the third year of their terms and until their successors have been duly elected and qualified. The term of office for Directors in Class I expires at the 2015 Annual Meeting, Class II at the next succeeding annual meeting and Class III at the following succeeding annual meeting. This current classified board structure has been in place since 1987.